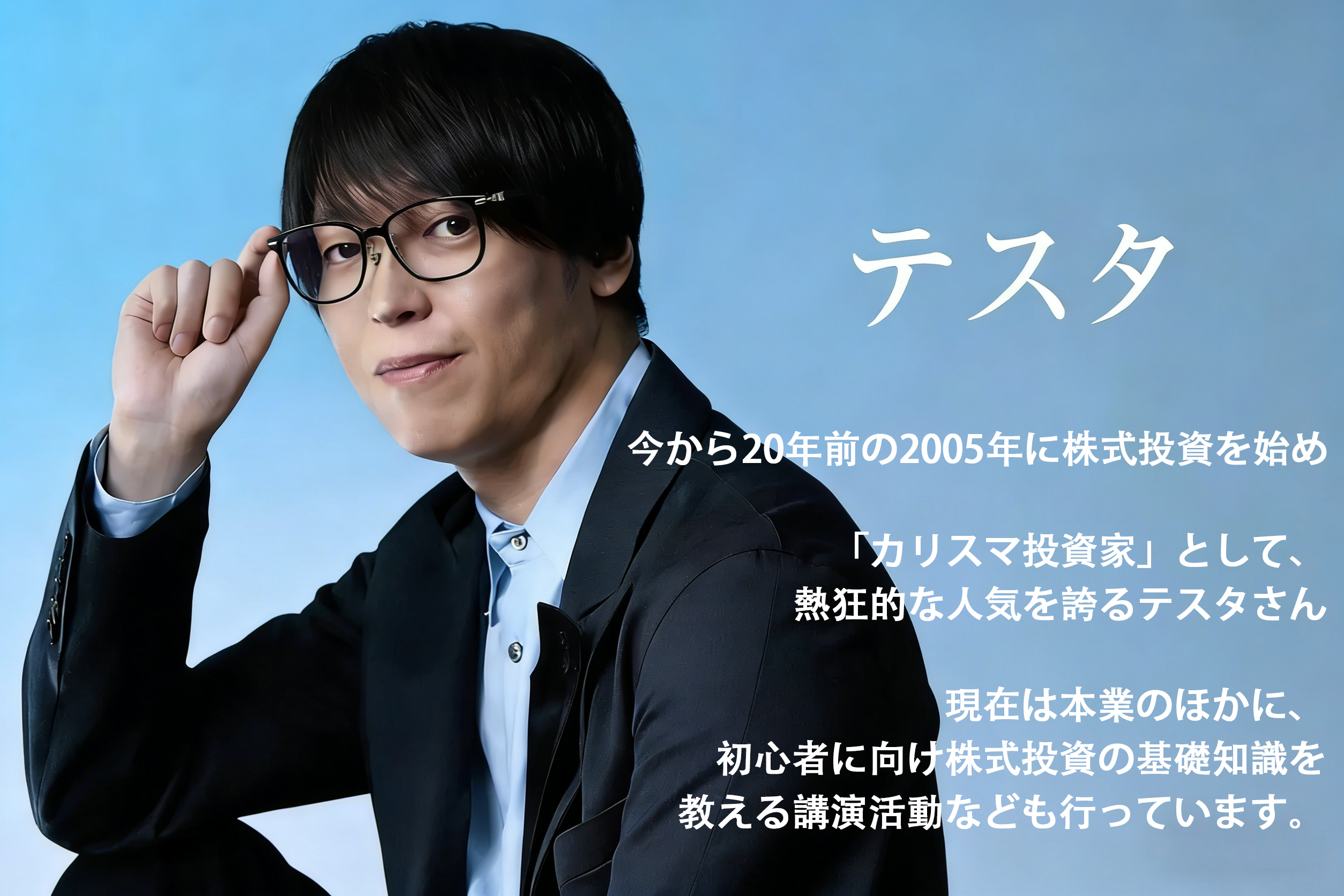

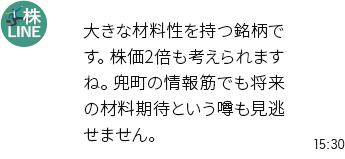

LINE友だち追加で 大本命の急騰銘柄を今すぐ入手可能

LINE友だち追加する

- ※ボタンをクリックするとLINE友だち追加画面に進みます。

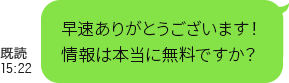

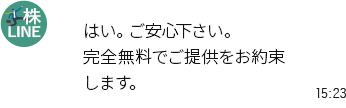

- ※LINEのサ-ビスは完全無料ですので、料金が発生することはありません。

- ※株式投資で遭遇した問題を先生と共有しよう。先着30名様は無料でVIPになれます!!!

01

今すぐあなたのLINEに

急騰銘柄情報が

完全無料で届きます!

02

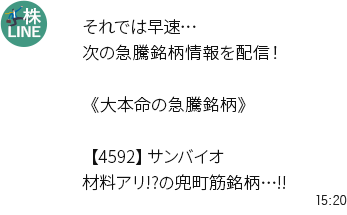

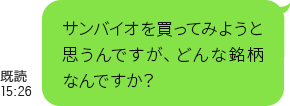

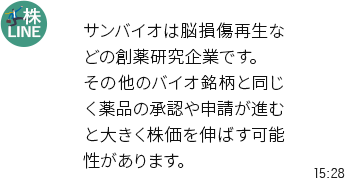

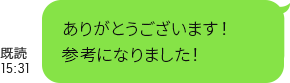

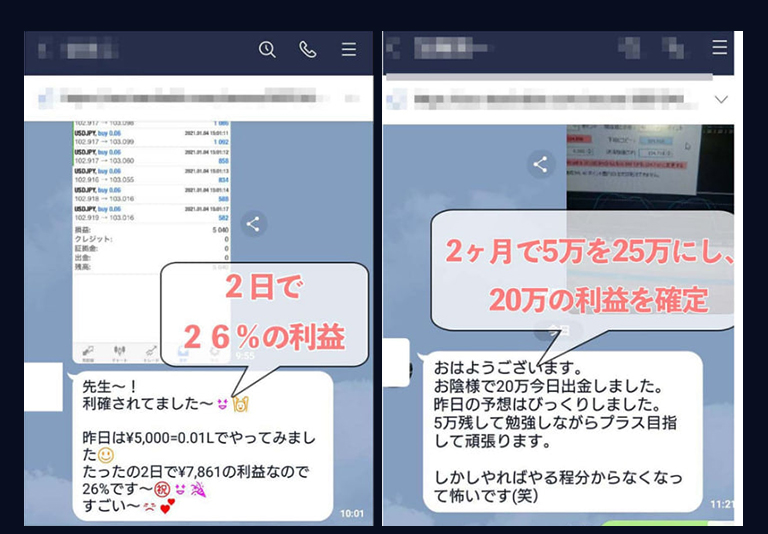

LINE配信される

株式投資情報をご活用頂くことで

1000万円を

超える利益を

手にされる方も続出しています!

株式投資に関するご相談・当LINEサービスへのご質問など、ご不明点がございましたらお気軽にLINEでご連絡ください!

お問い合わせはコチラ

LINE友だち追加で 大本命の急騰銘柄を今すぐ入手可能

LINE友だち追加する

- ※ボタンをクリックするとLINE友だち追加画面に進みます。

- ※完全無料0円のLINEサービスのためご料金の発生は一切ありません。

- ※株式投資で遭遇した問題を先生と共有しよう。先着30名様は無料でVIPになれます!!!